Technical security device (TSE)

Fiscalization for cash register systems

As of 1 January 2020 there are new legal requirements for POS systems. Since then, all electronic cash registers in Germany must be equipped with a technical security device (TSE).

Your advantages at a glance

- Fiscalization solutions for all POS systems

- Easy integration and centralized administration

- Reliable, high-performance and convenient billing process

Product details

The use of the technical security device (TSE) prevents sales suppression and tax avoidance (learn more on this topic at our topic page Fiscalization).

D-Trust offers different possible solutions for the technical security device (TSE) – all certified by the Federal Office for Information Security (BSI) according to common criteria and TR-03153:

- a Cloud TSE - the Fiskal Cloud - jointly developed by Deutsche Fiskal and D-Trust. The Fiskal Cloud can be used for the most prevalent operating systems and modes. This also includes mobile operating systems such as Android as well as offline-capable cash registers.

- a hybrid solution of cloud and hardware TSE that enables the centralised administration of local installations via the web service.

We are more than happy to advise you on the most suitable solution for your application scenario.

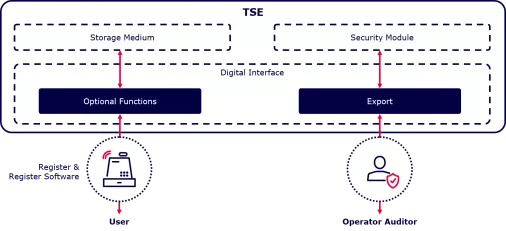

schematic structure Technical security device

Frequently Asked Questions

The term fiscalization sums up the legally compliant implementation of the extensive requirements of the German tax authorities for tamper-proof POS systems. The secure signature of each transaction is designed to prevent cash register tax evasion. Implementation must be completed by 31 December 2019.

The TSE is a certified technical security device with three components:

- Security module: The security module ensures that cash register entries are logged as soon as the recording process begins and cannot be changed later without being noticed.

- Storage medium: The individual records are stored on the storage medium for the duration of the retention period required by law.

- Uniform digital interface: The digital interface is designed to ensure smooth data transmission for testing purposes.

D-Trust offers implementation of the Technical Security Equipment (TSE) in two solution versions: Technical Security Equipment (TSE) in the form of a microSD card (hardware module), which can also be used for USB and SD card connections by means of an adapter, and a cloud-based web service called Fiskal Cloud together with Deutsche Fiskal.

The TSE module is suitable especially for small businesses that usually only operate one cash register and have not been online before. In this case, the modification by the cash register provider can be far more efficient than the cloud connection with all the technical adjustments. If there is a bad or no internet connection at all, the only option is the hardware solution.

The TSE module in the form of a microSD card can be used with an adapter for USB and SD card connections and integrated into the cash register. The TSE module from D-Trust is characterized by high security through future-proof crypto functions and a long use. In order to achieve a long recertification capability, the latest Javacard chip generation NXP SE050 was chosen as the basis of the TSE module.

The chip was specially developed for highly secure IoT application scenarios and has a large internal memory with high processing speed. It can store up to 20 million signatures. Therefore, the chip can be used at least until the mandatory recertification after five years. The TSE module is certified according to TR-3153 of the BSI.

The TSE module can also be used in hybrid operation with the web service solution Fiskal Cloud. D-Trust is the only provider that enables this hybrid operation by providing a local or central solution.

Please first ask your cash register provider whether he is already a sales partner of D-Trust for the hardware TSE module. If this is not the case, please contact us at:

Thomas Friedrich

Account Support Manager

+49 (30) 2598 – 0

E-Mail: support-tse@d-trust.net

The Fiskal Cloud is completely web-based and therefore it requires a secure internet connection. The POS systems communicate in encrypted form via a highly secure trusted channel with the servers of D-Trust and Deutsche Fiskal.

D-Trust takes over the TSE in its data center and thus the electronic signature of the cash receipts. In the meantime, user administration, monitoring and billing are running on the Deutsche Fiskal server. Although the certificates need to be renewed at regular intervals, it is not necessary to exchanged the TSE.

The certification according to Common Criteria (CC) and TR -03153 in version 1 with the BSI-K-TR-0369-2020 certificate being issued by BSI on September 30, 2020 has been completed.

Further information on the Fiskal Cloud can be found on the Deutsche Fiskal website. If required, you can also sign up for information events in the Training section.

Please first ask your cash register provider whether they are already a sales partner of Deutsche Fiskal. If this is not the case, contact Deutsche Fiskal directly by email: info@deutsche-fiskal.de.

The cloud solution is suitable for companies whose POS systems are already online as well as for companies with a central infrastructure and many cash registers or branches. These include large retail chains, supermarkets, pharmacies, petrol stations and also companies from the catering sector. The advantage of the cloud solution is that companies don't have to convert each cash register. This can cause immense costs if there is a large number of cash registers. Instead, they can be simply connect to the Fiskal Cloud via a web service.

Do you have any questions about fiscalization or the TSE module?

Our contact person will be happy to help you:

+49 (30) 2598-0

support-tse@d-trust.net